The financial toxicity of breast cancer

How the high cost of care is overwhelming people

- 03/21/23

Keneene still remembers sitting in the parking lot after each day’s radiation therapy treatment, checking her bank account to make sure she had enough to pay the fee so she could drive home to her teenage daughter. A fiercely independent woman, Keneene fights back tears as she tells the story. But today she has had no evidence of cancer for over three years, and she strives to help other people manage their financial burdens every day, working at Living Beyond Breast Cancer.

The most expensive form of cancer

Researchers use the term “financial toxicity” or “financial distress” to describe problems related to the costs of healthcare. According to the Centers for Disease Control, breast cancer has the highest overall treatment cost of any cancer in the U.S. Pam Traxel, senior vice president of the American Cancer Society Cancer Action Network, says that this is partly due to great progress in breast cancer survival, so costs continue for many years. Reconstruction may require multiple surgeries; some therapies— especially those for metastatic disease — can cost upward of $18,000 per month.

Linda discovered this in late 2018, when she was diagnosed with breast cancer that had already spread to her liver. She had retired early from her job with the state of Ohio to care for her father who had Alzheimer’s disease. With her state pension and healthcare plan, she looked like a person with “good insurance,” and she lived near a comprehensive cancer center. Linda immediately began taking palbociclib (Ibrance), a CDK 4/6 inhibitor to target her hormone receptor-positive cancer, along with anti-estrogen therapy. “This drug is literally saving my life and I’m doing well,” she says. “At first, the cancer center coordinated with a specialty pharmacy to deliver medications to my home, and insurance paid $10,348 per month.” The center helped her find grants to cover her monthly copay of $2,219, and she managed for two years.

Everything changed in December 2020, the day of her dad’s funeral. “I was texting and calling the specialty pharmacy to find out why I hadn’t received that month’s medication. Finally, they said ‘You’ve run out of money. Your funding has stopped.’ I agreed to pay out-of-pocket for December and immediately called my pharmacy team. They contacted Pfizer [the manufacturer of the medication] and in January 2021, I was put on their patient assistance program, so I received my medicine with no charge.”

In 2022, state changes forced Linda to switch to a plan in the Affordable Care Act marketplace. Then she turned 65 in 2023, and everything changed again. Ibrance catapulted her into “catastrophic coverage” during her first month on Medicare, so she was charged $4,000 in March and then $800 each month for the rest of 2023.

Linda is not alone. A study published in 2018 found that nearly half of all people prescribed oral anticancer medications that cost over $2,000 did not even fill the prescriptions. Self-rationing was common.

But help is coming. The Inflation Reduction Act of 2022 is a large package of federal laws designed to curb inflation, reduce the deficit, lower prescription drug prices, and promote clean energy production in the U.S. The new prescription drug regulations are rolling out over seven years, beginning in 2024. The exact impact on costs for people living with cancer is not yet clear.

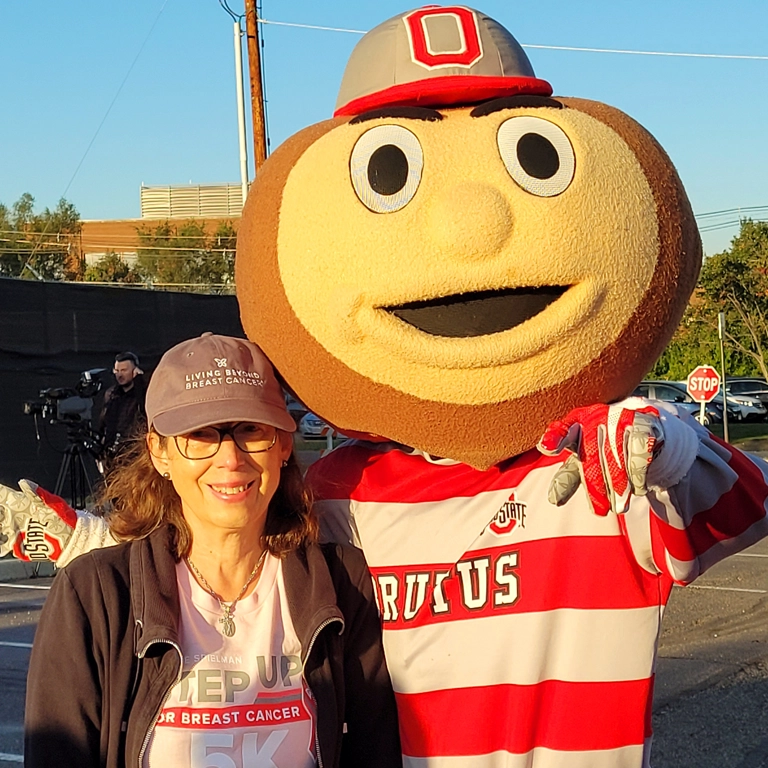

l: Linda with Brutus Buckeye, the Ohio State mascot; r: Pam Traxel, senior vice president of the ACSCAN

All ages and stages feel the stress

“The stress of finances is a source of agony for all cancer patients,” says retired oncology nurse Caroline, who keeps spreadsheets of all her claims. “I have spent countless hours on phone calls and writing appeals.” Caroline’s first diagnosis was stage IIA breast cancer, when her daughter was in 7th grade and her son was a sophomore in high school. Despite two working parents, the family was “in collections” at one point. A home equity line of credit allowed them to pay off those medical debts and Caroline went back to work. They managed to put their children through college.

However, at age 55, Caroline developed metastatic breast cancer to her bones. Her job as a bedside nurse—standing for 12-hour shifts and lifting up to 75 pounds — became impossible. She left work and moved onto her husband’s insurance plan. But once she became eligible for Medicare in 2022, a complex web of rules with her Medicare supplement meant that third-party payers automatically paid inaccurate bills, leaving her owing large amounts. Even after she got her elected state representative to call her insurance company, the billing errors were never corrected.

Younger women with breast cancer also experience financial toxicity. One study of people under 40 showed that nearly half suffered some financial hardship. Their employment decisions were driven by their insurance needs, leading to career disruptions and financial declines.

With stage IV cancer, managing bills is not what I should be spending my time on. I should be learning a new meditation technique or baking cookies for the kids.

Cancer touches the entire family

“If I weren’t sick, my husband would take early retirement,” says Caroline. “But he feels trapped because I have cancer. He’s so kind and loving, he never says it like that, but I know it’s true. We don’t want to leave big medical debts to our children. With stage IV cancer, managing bills is not what I should be spending my time on. I should be learning a new meditation technique or baking cookies for the kids.”

Caroline has even researched “medical divorce*,” an extreme measure in which spouses divorce on paper, allowing the person with a qualifying disease to apply for Medicaid while their partner holds onto assets like a house or savings that are needed for the whole family. But Caroline’s husband refuses to even consider it: “No way!” he says, “I took vows ‘in sickness and in health.’”

NOTE: Before considering a medical divorce, every couple should speak with a tax or legal professional and a social worker (available at their hospital or cancer center). It is especially important to have in place powers of attorney (both general and healthcare-specific) and wills, and specifically name beneficiaries for any assets such as 401K’s, bank accounts, investment accounts and property.

Keneene’s daughter Kalista, a gifted singer, won a scholarship to spend a summer at the prestigious Berklee College of Music in Boston — far from their home in Atlanta. But the award didn’t include travel or living expenses and Keneene was in the midst of aggressive chemotherapy. Her salary at the time barely covered rent and food, let alone all her treatment. A trip to Boston seemed impossible. Encouraged by her pastor, Keneene put aside a lifetime of independence to launch a GoFundMe campaign online. “We were completely humbled, shocked and thankful,” she recalls. “Even people who didn’t know us contributed, some saying they wish someone had done this for them when they were young and had a dream.” They exceeded their goal, and when Kalista called the first day to say she had finally found “her people,” Keneene rejoiced in her infusion chair.

Finances deepen inequity

On top of large disparities in survival between Black and white people with breast cancer, research by the American Cancer Society Cancer Action Network and others consistently shows that financial hardship is also related to factors such as race/ethnicity, health insurance status, income, and place of residence. The National Consumer Law Center documented that African American and Black people with cancer are more likely to have medical debt and to suffer aggressive debt-collection practices.

The Centers for Disease Control found that over 56% of privately insured Black cancer survivors have high-deductible health plans (HDHPs). These plans have lower monthly premiums but generate large upfront costs for people when they become ill, often causing them to delay important care. Delays can also lead to worse treatment outcomes.

Unfortunately, recent federal legislation declaring the “end” of the pandemic means that health insurance will start disappearing entirely for millions of people who enrolled in Medicaid under the Families First Coronavirus Response Act (FFCRA). As of April 2023, states that accepted enhanced Medicaid funding during the pandemic can begin dropping people from coverage.

Medical debt: The system is broken, not you

According to a 2022 investigation by the Kaiser Health Network and National Public Radio, 100 million people in the U.S. ― one in three Americans — are in debt due to medical expenses. Rishi Manchanda, MD, MPH, a physician on the board of the nonprofit RIP Medical Debt, said simply, “We have a health care system almost perfectly designed to create debt.”

People use various strategies to handle medical debt, including loans from friends and family, home equity lines of credit or second mortgages, delaying education, “going without,” and moving in with others. But many skip medicine or care altogether. Caroline spends hours every week pouring over her spreadsheets, yet her first question when she walks into physical therapy is: “Are we sure it’s still covered?” Keneene often chooses between something her daughter wants and her own $100 specialist copay.

Faith communities and other social networks often help with groceries, rides, childcare, or household chores. But medical debt can grow to tens of thousands of dollars. It is not solved by a bake sale.

We have a health care system almost perfectly designed to create debt.

Bankruptcy is a mixed bag

From the day Keneene found a lump, until she rang the bell after four months of radiation therapy, she experienced a blur of endless days in diagnosis and treatment — all while working, finishing her master’s degree with honors, and trying to help her daughter have a jubilant senior year. A wave of bills started arriving despite her insurance, and she dreaded answering the phone due to aggressive creditors. When Keneene’s wages were garnished for payment of her hospital debt, it seemed like bankruptcy was her only option. She used a recommended local law firm that specializes in medical bankruptcy, and her breast cancer debt was wiped out except for $1,800.

Keneene describes the process as a blessing and a curse. “I had the immediate relief of wiping the slate clean and starting over financially. But I also have that Scarlet C on my chest.” She cannot move into a larger apartment because landlords demand a certain number of years without bankruptcy on her record. The same goes for buying life insurance to protect her daughter and taking a better job in a new state. “There’s never going to be an ’Easy Button‘ for me,” says Keneene, ironically referencing the Staples ad campaign, “but I’m an over-comer and a thriver.”

There’s never going to be an ‘Easy Button‘ for me, but I’m an over-comer and a thriver.

Self-funding web campaigns

GoFundMe or FundRazr often bring out the best in people, as Keneene and Kalista discovered when they exceeded their campaign goals. In the U.S., donations are considered gifts, not income, by the IRS, so they are not currently taxed. These gifts are not tax-deductible for the donor. However, IRS regulations regarding self-funding sites are under review in the U.S., so it’s important to consult a tax advisor before launching a campaign.

Sheri had already survived a rare cancer of the eye (ocular melanoma) when she was diagnosed with an aggressive form of breast cancer and decided to have a bilateral mastectomy. A single mom, she chose to travel from home in Vermont to a renowned cancer center in Boston to maximize her chances of survival. Despite having insurance through her state job, plus a loan and a few grants, she turned to a GoFundMe campaign during chemotherapy. Her web page breaks down expenses (such as lost wages, travel, and complementary therapies like acupuncture) and includes upbeat photos of her with her son and friends.

Sheri and her son in a photo from her GoFundMe page

Managing stress by speaking up

People have different ways to manage the many stresses of breast cancer, including meditation, exercise, journaling, spending time in nature, and movie or game night with friends. However, Linda discovered that making her voice heard though advocacy is her most uplifting activity. In a support group at her cancer center she met Tori Geib, the first person living with MBC she had encountered. “She was so much younger than me and when she started talking about her advocacy, I was in awe,” Linda recalls. Thanks to Tori, Linda began writing letters to her elected officials, ultimately going to lobbying days at the Ohio State House. She realized that she has a voice, and it matters.

Concerned about this issue?

We encourage members of our community to take these steps:

- Enter your zip code in this tool to get the names and contact info for your senator and congressperson.

- Contact your congresspeople to share your personal story about why financial toxicity is important to you.

- Visit FightCancer.org to learn more about how to help influence policies around cancer and upload your story.